Are payroll taxes sneaking up to cause a storm for your business? There’s no skirting around the fact that unfiled or unpaid payroll taxes can create real hassles if you’re a business owner with employees. Both the IRS and state-level entities are going to notice if you’ve failed to address payroll taxes correctly.

Are payroll taxes sneaking up to cause a storm for your business? There’s no skirting around the fact that unfiled or unpaid payroll taxes can create real hassles if you’re a business owner with employees. Both the IRS and state-level entities are going to notice if you’ve failed to address payroll taxes correctly.

Many business owners are unaware that the IRS actually prioritizes collecting payroll taxes over things like collecting owed income tax. Thus, there is a lot on the line if payroll taxes have potentially been neglected or mishandled. Here are three likely consequences of failing to handle payroll taxes impeccably:

- Costly penalties

- The IRS going after a company’s assets

- The IRS holding a business owner personally liable

The IRS will conduct a thorough investigation once it learns that payroll taxes have been mishandled. An investigation usually involves in-person interviews with different members of a company, and a routine investigation by the IRS can quickly turn into a federal felony investigation if there is any hint of fraud. This is one of the reasons why we emphasize taking care of unpaid payroll taxes while the problem is still small and can be handled through paperwork.

Why Payroll Taxes Can Be Problematic

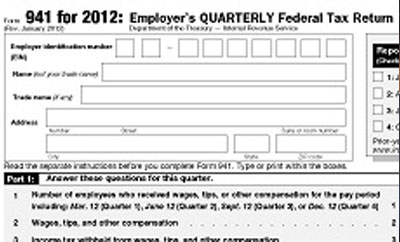

Are you as a business owner familiar with your obligation for payroll taxes? The IRS requires you to withhold federal income taxes, Social Security taxes, and Medicare taxes from employee wages based on the W-4 information of each employee. Quarterly payments must be made during the months of March, June, September, and December. Some small business owners may also file payroll taxes strictly on an annual basis. Unfortunately, on-time and complete payments don’t always happen.

Handling payroll taxes is just one more thing on the plate of a business owner. Some first-time business owners are unaware of the filing requirements. Others face the decision to use funds collected for payroll taxes to cover pressing business obligations just to keep going. Of course, the complexities of handling payroll taxes only add to the need for ongoing professional tax services.

What Happens When You Have Late Payroll Taxes?

The penalties can roll in quickly and heavily once a business fails to pay payroll taxes. You’re looking at penalties totaling 5 to 25 percent of what’s owed per month. Additional penalties and compounding interest can quickly create a very expensive situation. Here’s a look at some of the unpaid payroll taxes IRS consequences that can be enforced:

- Garnishments

- Bank levies

- Seizure of business assets, equipment, automobiles, and incoming payments

- Closure of a business

You should know that a business closure doesn’t end the story. The IRS will look toward the owner of a business if a business closes or files for bankruptcy protection. It will do all that it can within the law to collect taxes, interest, and penalties. One particularly bitter consequence is when the IRS goes after the person responsible for paying payroll taxes using something called the Trust Fund Recovery Penalty (TFRP). Bank accounts, home equity, and liquid assets can all be pursued by the IRS under this penalty.

Is There a Way Out When You’re Dealing With Late or Unpaid Payroll Taxes?

You may feel like you have your back against a wall if you’re facing an IRS payroll tax late payment penalty. You should act quickly to avoid letting available options expire or slip through the cracks, as it may not be too late to save your business and reduce penalties.

You should first meet with a tax professional to discuss the available options – and it’s important to get your representation in place before you meet with an agent from the state or IRS.

The good news is that you may be able to request an installment agreement to pay what you owe in back payroll taxes in full. However, this option is only available if you owe under a certain amount. The team at the Tax Center Group will work hard to keep you out of the collections phase and avoid payroll tax penalties IRS agents can throw your way. We can help whether your business is currently defunct or fully operating. You may find that options like Currently Non Collectible (CNC) status, payment plans, and other relief solutions are applicable.

Get Help With Late or Unpaid Payroll Taxes Now

The Tax Group Center is backed by 30 years of tax experience. Our team of licensed tax professionals, CPAs, and lawyers is passionate about solving all your tax problems. We can show you how to utilize any and every resource available for walking away with as little liability as possible. Call the experts at the Tax Group Center today to avoid a damaging IRS payroll tax late payment penalty!