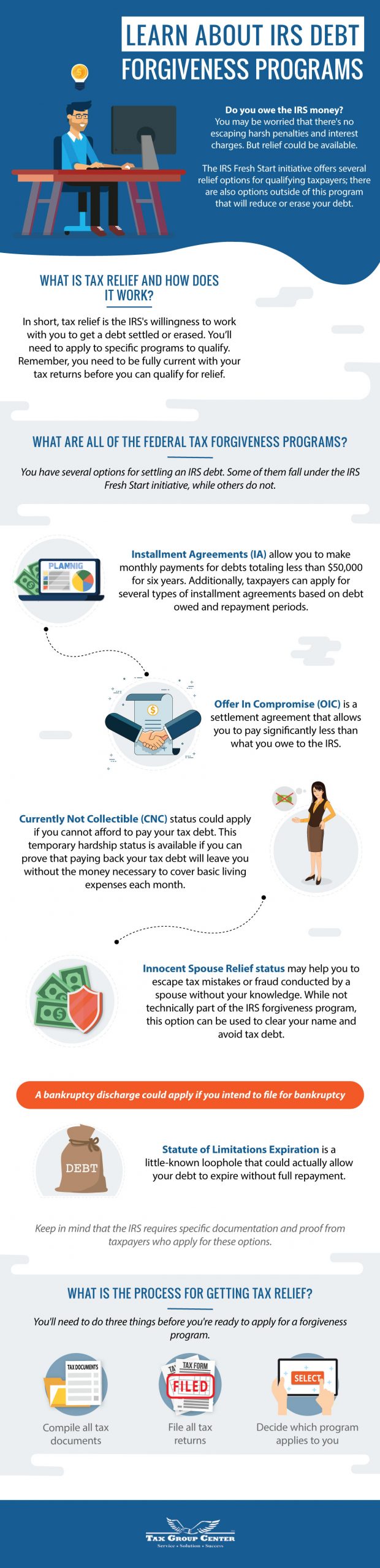

Do you owe the IRS money? You may be worried that there’s no escaping harsh penalties and interest charges. But relief could be available. The IRS Fresh Start initiative offers several relief options for qualifying taxpayers; there are also options outside of this program that will reduce or erase your debt.

Share this Image On Your Site

What Is Tax Relief and How Does It Work?

In short, tax relief is the IRS’s willingness to work with you to get a debt settled or erased. You’ll need to apply to specific programs to qualify. Remember, you need to be fully current with your tax returns before you can qualify for relief.

What Are All of the Federal Tax Forgiveness Programs?

You have several options for settling an IRS debt. Some of them fall under the IRS Fresh Start initiative, while others do not. Here’s a look at each one:

- Installment Agreements (IA) allow you to make monthly payments for debts totaling less than $50,000 for six years. Additionally, taxpayers can apply for several types of installment agreements based on debt owed and repayment periods.

- Offer In Compromise (OIC) is a settlement agreement that allows you to pay significantly less than what you owe to the IRS.

- Currently Not Collectible (CNC) status could apply if you cannot afford to pay your tax debt. This temporary hardship status is available if you can prove that paying back your tax debt will leave you without the money necessary to cover basic living expenses each month.

- Innocent Spouse Relief status may help you to escape tax mistakes or fraud conducted by a spouse without your knowledge. While not technically part of the IRS forgiveness program, this option can be used to clear your name and avoid tax debt.

- A bankruptcy discharge could apply if you intend to file for bankruptcy.

- Statute of Limitations Expiration is a little-known loophole that could actually allow your debt to expire without full repayment.

Keep in mind that the IRS requires specific documentation and proof from taxpayers who apply for these options.

What Is the Process for Getting Tax Relief?

You’ll need to do three things before you’re ready to apply for a forgiveness program:

- Compile all tax documents

- File all tax returns

- Decide which program applies to you