There are very few sure things in life. Taxes cannot be avoided. Despite the definitive, many people still find themselves owing the government thousands of dollars. They might go for years without paying a single, tax dollar. Penalties and late charges add up into astronomical figures. It’s only natural to ask why people fall behind on their taxes. Take an in-depth look at society and its relationship to taxes so that you have a better understanding.

Lack of Funds

People run into tax problems when they don’t have the funds to cover the amount. They might feel shame or frustration. Paying for everyday basics, such as groceries, may be the biggest concern. The taxes are put on the back burner until better days arrive.

People run into tax problems when they don’t have the funds to cover the amount. They might feel shame or frustration. Paying for everyday basics, such as groceries, may be the biggest concern. The taxes are put on the back burner until better days arrive.

If you’re having a cash-flow problem, speaking directly to the IRS or Internal Revenue Service is your best course of action. They can create a payback schedule that works with your budget. Paying no taxes at all will only compound the problem.

Forgetting to File

Although it may seem implausible, some people do forget to file their taxes. These individuals might work abroad or at charitable institutions. They don’t intend to skip one or two years of tax payments. The time frame just got away from them.

Although it may seem implausible, some people do forget to file their taxes. These individuals might work abroad or at charitable institutions. They don’t intend to skip one or two years of tax payments. The time frame just got away from them.

Forgetting to file your taxes isn’t an excuse, however. The government will collect the funds at some point. It’s always a better idea to pay the taxes as soon as they’re recalled to memory.

Failing to File

It’s possible that some adults don’t know if they should file taxes in the first place. Owing taxes can be a confusing situation. Your job probably withholds a certain amount from each paycheck. Thinking that the taxes are covered and no filing is necessary can happen.

Most full-time workers must file their taxes. It’s a federal law that’s upheld in a court of law.

Dealing with Extenuating Circumstances

People fall behind on their taxes because of a few, common situations, such as:

People fall behind on their taxes because of a few, common situations, such as:

• Death in the family

• Divorce

• Unemployment

• Illness

These extreme circumstances make it difficult for taxpayers to remember the filing date or to follow the forms’ instructions. They may not be physically able to complete the forms either. Ideally, the taxpayer should seek out professional help so that the funds are covered as necessary. At that point, they can focus on their extenuating circumstances.

Being a Cosigner

A specific instance where a taxpayer has trouble paying their owed taxes is when they’re assigned as a cosigner. You may have cosigned a loan with a loved one. The family member can’t pay back the loan so it’s now your burden to bear. All of your funds, as a result, are funneled to this loan.

If you owe taxes, there’s no money to allocate toward them. Your paycheck might be under garnishment too.

Becoming Too Busy

Falling behind on your taxes may be a case of a disorganized lifestyle. You don’t have the time to fill out the forms or figure out the credits. Throwing up your hands in frustration and scrapping the entire process is an excuse shared among many people. These adults must change their perception of taxes and pay them as needed. They’ll only save themselves from frustration in the end.

Falling behind on your taxes may be a case of a disorganized lifestyle. You don’t have the time to fill out the forms or figure out the credits. Throwing up your hands in frustration and scrapping the entire process is an excuse shared among many people. These adults must change their perception of taxes and pay them as needed. They’ll only save themselves from frustration in the end.

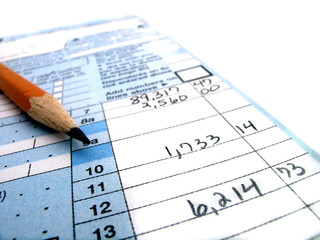

Mistaking Credits on Tax Forms

There are hundreds of credits and exceptions on a standard, tax form. Some people might be overwhelmed at the selection, and they end up choosing a credit that they don’t qualify for in the first place. These taxpayers end up filing the forms, but they end up owing more taxes in the process.

Mistakes on tax forms can cost taxpayers dearly. Professional help might be the safer route to take.

Misunderstanding Estimated Tax Payments

If you’re a self-employed person or run a business, paying estimated tax payments is part of your financial world. Every quarter, you send a check payment to the government to cover your taxes. However, some taxpayers don’t understand their estimated payments. They may underpay them or forget altogether. The government will request the funds if they aren’t paid by the due dates. Business owners may want to consult their accountants to verify which payments are currently due.

Confusing Withholding Structure on Paychecks

The simplest way to pay your taxes through the year is by withholding them in a paycheck. You never see the funds. They’re simply tucked away for the government’s use. Be sure that you’re withholding enough funds to cover your taxes. Filing a form with your employer can make the process a simple one. You can withhold any amount that you desire.

The simplest way to pay your taxes through the year is by withholding them in a paycheck. You never see the funds. They’re simply tucked away for the government’s use. Be sure that you’re withholding enough funds to cover your taxes. Filing a form with your employer can make the process a simple one. You can withhold any amount that you desire.

Working With Tax Group Center in the Event You Fall Behind on your Taxes

If you haven’t paid taxes or received a bill in the mail, you need to deal with the situation as quickly as possible. Tax bills won’t vanish overnight. You must pay part or all of the taxes owed. They must be paid in a reasonable amount of time.

Tax help is right around the corner. Tax Group Center offers a mixture of both tax preparers and lawyers. We understand the legalities behind unpaid taxes. Our tax professionals work directly with the IRS to defend your position. We also protect your rights so that the repayment agreement is within your income bracket.

Your taxes pay for core services in your neighborhood, from paving roads to supporting the fire department. Consider your taxes as funds toward a better tomorrow. Paying them helps everyone with a better life than before.